Everyone applies for a loan at least once in their life. But there is no guarantee that your loan application will be approved. Most loan applications in the UAE are simply rejected due to a low credit rating. It is not easy to get a loan without a credit rating check in the UAE.

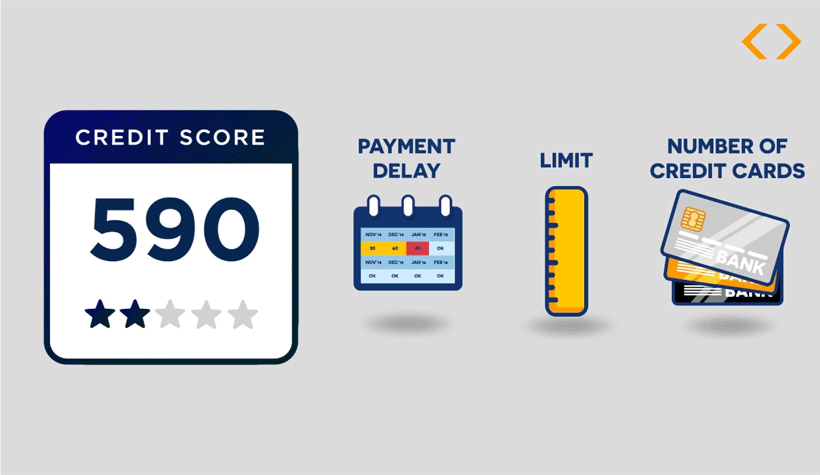

As we all know, banks in the UAE will check the credit history of job seekers and attach great importance to the credit rating of job seekers. They will only approve loan applications if they have a good credit rating, that is, it must be above 580 to be approved. The higher the credit rating, the better the chances of loan approval.

Why does the bank check credit history?

Be sure to check your Etihad Credit Bureau (AECB) credit report before approving a credit bank. The credit report provided by the AECB contains all financial information about the applicant, including previous and current loans, number of credit cards, monthly income, and credit rating. They measure a person’s ability to pay off the loan and installment payments on time, taking into account your cash inflows and outflows, and the debt burden ratio without any burden.

How to get a loan without a credit rating check?

It is not easy for people with a low credit rating to get loans from banks. There are banks that provide non-wage loans and personal loans to non-listed companies, but no bank in the UAE shuns low credit ratings or provides unsecured loans.

Apart from personal loans in the UAE, there are several options that you can consider in order to obtain a loan.

Peer-to-peer lending platform

When someone needs extra money, the first thing that comes to mind is to ask a friend. It does work, but not always and not necessarily when you need a large loan.

Then, in this case, private lenders will appear. Few officially authorized private lenders in the UAE provide loans to applicants with low credit ratings. As a rule, private lenders do not provide loans for credit checks. They just hand over some kind of identity documents.

Even if you get cash instantly, private lenders will charge very high interest rates, which can be double the bank interest rates. This is one of the reasons private lenders are the wrong choice.

Mortgage

Banks pay particular attention to credit assessment when providing unsecured loans, but in the case of secured loans, they may consider loan applications without a credit check in the UAE, but they can receive high profit margins that can vary from bank to bank. You can pledge assets like cars and gold as collateral and receive loans.

Take advantage of a credit card loan

If you have a credit card, it can be the equivalent of an asset. You can get a loan with a credit card or use the UAE cash advance option. But getting a credit card loan is not recommended because it is offered at a very high interest rate, which can be a huge burden.

Advance wages

For hired personnel, this is the best choice. Workers can receive loans based on their monthly income. There are various popular banks in the UAE such as RAK Bank, UAE NBD, Dubai Islamic Bank, ADCB, etc., which provide loans on your salary at competitive interest rates.

In addition, there are various other options for obtaining loans in the UAE that you can consider and achieve your short term goals.

At the same time, try to improve your credit rating, which can have a bigger impact when needed. It will take at least 7 years to get rid of bad credit ratings, according to the report. If you pay credit cards and other payments on time without any delay for 3 months in a row, your credit score may improve. Also, once you reach it, try to maintain good grades.

I need loan sir/ma to start up business

I need a personal loan.