A salary certificate is an authentication document issued to the employee from the organization he is employed. This document is required in various tax documentations as it determines how much tax an employee would be paying.

Salary certificate and letter are two very easily confusing terms. A salary certificate and salary letter are similar in the way that they are both required in dealing with some sort of financial crisis or other situation such as buying a car, purchasing a property, or getting a loan. On contacting a financial institution like a bank, a list of documents is provided to process the loan application. Some organizations prefer salary certificate over a salary letter. A salary letter is more or less a request to the employer to issue the employee’s salary. Salary letter is a memo between employee and head of the institution.

Read More: Zero Balance Accounts in UAE

Salary Certificate, however, is a document used by an employee to offer a proof of both employment in a certain organization and mentions what amount an employee was earning in his tenure. This serves as a proof of income for the employee and can be produced when needed in case of applying for loans, Immigration etc.

Where is it needed?

Either it be a personal, home, or car loan, one of the immediate requirements of any banks is the Salary Certificate along with other documents like loan application, Passport (Expats), Emirates ID (UAE Nationals) and Bank Account statements.

Format:

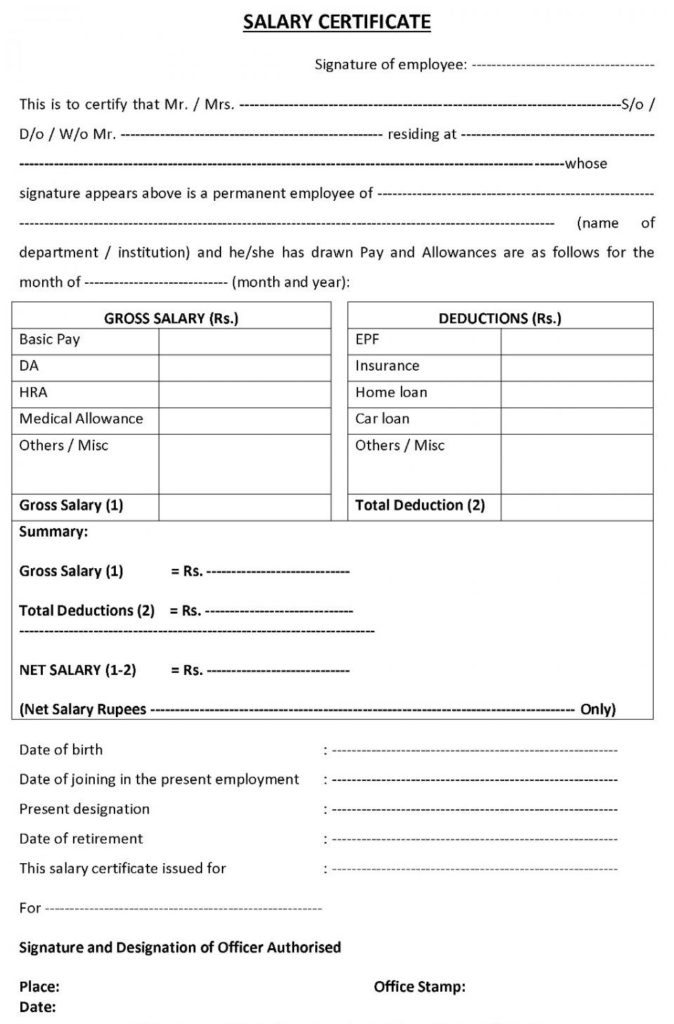

Like every formal document, there is a certain format that has to be followed for the salary certificate. The format varies from bank to bank depending on the additional documents needed to be attached. The basic format involves the following elements:

- Name of the Employee

- Salary

- Tenure of working

- Purpose of issuing the Salary Certificate

- Signature of authorized officer along with a designation

- Official stamp

- The salary section should also include information such as Basic Pay, DA(Dearness Allowance), HRA(House Rent Allowance), Medical Allowance

Read More: Top 5 Saving Accounts In Dubai

Types of Salary Certificate:

There are two types of Salary Certificates which are mentioned as following:

Salary Certificate and the other is the Salary Certificate Letter, both of these have the same format but the Salary Certificate is written to a particular institution and cannot be put up in other banks if loan rejection has taken place. Salary Certificate Letter, however, is aimed towards a certain bank and in case the bank being referred to reject the loan application, it can be used for some other bank again. Other than these minor differences, both of these documents are essentially the same.

Read More: Top 10 Credit Cards in UAE 2019

The major need for a salary certificate or salary letter arises during the processing of a personal loan and therefore is very necessary. No bank caters to any application of a loan unless a salary certificate along with the required documents is available. Bank statements of credited salary do not help much as the exact salary along with the tenure and other details like the signature of an authorized individual are extremely necessary.

It’s always convenient to have the salary letter format ready to request a salary certificate to avoid delays in the processing of the loan and other requests.