Insurance is a form or technique hedging financial risk. It is a form of protection against a future possible event. Insurance companies take the responsibility of covering for big or small kinds of loss in which they provide financial protection or reimbursements to their clients, which can be companies or individuals.

The development of the UAE as a global business hub in the Middle East has led to a substantial increase in the number of business owners and investors in the UAE. Dubai, the city which is also known as the Golden City, is one of the richest emirates in the United Arab Emirates, attracting professionals, tourists , business owners, investors, and travelers from around the world. As the number of immigrants and locals grows, so does the demand for insurance in Dubai and the UAE. There are many insurance companies in Dubai that offer services and goods to protect the future of immigrants and their families.

Purchasing insurance is one of the needs of individuals, and this is how insurers form the center of the economy by providing security against various things.

These companies in the UAE will take you to your business, personal life, health, etc. It protects you from unexpected events you may encounter.

There are many types of insurance companies which provide products like life insurance and auto insurance, and medical insurance in the UAE. There are different providers, banks and brokers offering many policies. Choosing the appropriate general insurance policy among these is a surprising task for anyone.

In order to choose the one that meets most of your preferences, it is necessary to understand the terms of the program and the supplier’s presence in the market. This can be decided based on the Accrual Request Rate (ICR), which shows the financial capabilities and ability to pay for insurance companies in Dubai.

You can also analyze based on policy benefits, other ranges, discounts, and restrictions. Before buying a plan or insurance in the UAE, it is highly advised to check the documents and statements first for the policy, because the general insurance policy may change, when it comes to comprehensive insurance,

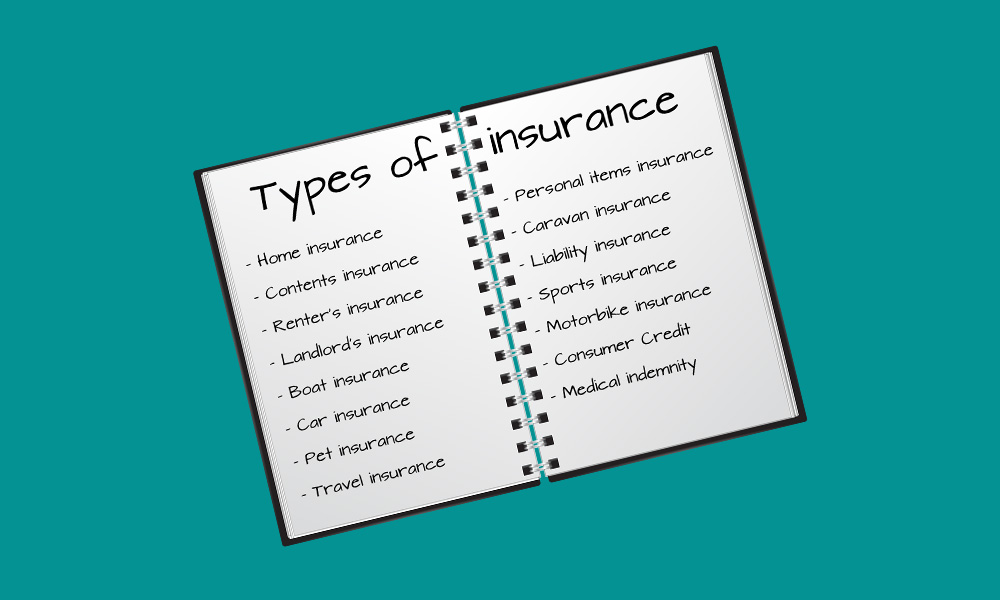

Types of Insurance in the UAE

Insurances are of many types and may vary across the needs of an individual

- Personal Insurance (Health, homeowners, auto, travel, and life)

- Property insurance

- Liability insurance

- Fire insurance

- Guarantee insurance (such insurance policies are taken in cases like where there are disloyalty, dishonesty, or chances of the second party backing out.)

- Social Insurance

How does Insurance work?

It’s a contract between two people i.e., the insurer (insurance company) and the insured (customer). Insurance companies devise policies in which they set the terms and conditions of the insurance policy they will provide, like the policy limit, premium (price), and deductibles.

Premium/ price is the monthly expense the customers pay to the insurance company, which they pool together to pay for the future losses of their customers. The premium is in line with government regulations. Insurance companies don’t charge huge premium amounts because they don’t want customers to run away.

Read Also: Top Car Insurance Policies in the UAE

The policy limit is the preset amount of time the insurance company will pay for the covered losses under the policy. The limit could be per injury, per loss, etc. It could also be over the entire life of the system that is known as the lifetime maximum. A policy with higher policy limits has high premiums.

Lastly, the deductible is the amount the insured person pays out of his/her pocket before the insurance company pays for the losses. The deductibles act as a warning against several claims. They can be applied on a per-insurance basis depending on the insurer and type of Insurance.

Top 10 insurance companies in the UAE

- Emirates Insurance Company

- AXA insurance Gulf BSC

- Nas Admin service LLC

- Chartered Insurance Institute Group Middle East

- Al Fujairah Insurance Company

- Oman Life Insurance

- Abu Dhabi National Takaful Co.

- Al Dhafra Insurance Company

- Al Sagr National Insurance Company:

- Watania Insurance

1. Emirates Insurance Company

Established in 1982 by Sheikh Zayed bin Sultan Al Nahyan by law, no.6 is one of the leading insurance companies in UAE. It started with a small number of employees and is now known as the best insurance company in the entire Gulf Cooperation Council region. The company offers the best premiums and is the 4th largest insurance company as per gross written premium.

2. AXA insurance Gulf BSC

One of the largest global insurers and a universal leader in Insurance and Asset Management. AXA has been in the Gulf region for more than 68 years, offering a wide range of insurance products and services for individuals, companies, and small, medium enterprises.

AXA is one of the most significant international players in the GCC, covering the UAE, Oman, Bahrain, and Qatar markets. They offer services and products custom made for each individual in which they include casualties, property, life, and health insurance.

Read Also: Top 10 Credit Cards in UAE 2019

3. Nas Admin service LLC

The company has been operating in the GCC region since 2002, with its headquarters in Abu Dhabi. The company solely focused on providing medical and health insurance. The company has managed to provide adaptable and dynamic solutions in the market place to its business partners.

4. Chartered Insurance Institute Group Middle East

Gaenor Jones leading the operations as regional director for MEA and the Personal Finance Society Chartered Insurance Institute (CII), opened a new office to cover the Middle East and Africa (MEA) region. There is an increasing demand for the CII’s professional qualifications, training, and continuing professional development (CPD) in the area, which has made it a leading insurance and financial service provider.

5. Al Fujairah Insurance Company

Situated in the Eastern part of the country, this is the only insurance company that has its headquarters in Fujairah. The company was established in 1976, and since then, it has branches all over the country with a strong presence in Dubai, Sharjah, Dibba, Fujairah, and Abu Dhabi. The company serves massive clients. The company offers Insurance to all classes of Property and Casualties, including Motor Vehicles and Jet Aircrafts, Marine Vessels, Port Operators’ Liability, Group Life, Medical, and many more.

6. Oman Life Insurance

Oman Insurance Company (PSC), or OIC, is one of the leading insurance solution providers in the Middle East, headquartered in Dubai, United Arab Emirates. It has 15 branches and a strong presence in all UAE emirates, Oman and Qatar. It was founded in 1975; OIC is today a financially sound and professionally managed organization. The company practices specific customer-oriented services through high-quality products. OIC offers a full range of insurance solutions from life insurance, health insurance, and car insurance, personal Insurance to Insurance for medium to large industrial and commercial enterprises.

7. Abu Dhabi National Takaful Co.

Abu Dhabi National Takaful (“Takaful”) was established in November 2003 to provide Takaful’s insurance solutions for the local market. Headquartered in Abu Dhabi, with offices in Abu Dhabi, Al Ain, and Dubai covering the entire UAE. It is licensed by the ministry of commerce and is one of the Islamic companies working in the United Arab Emirates. The company offers products and services of all kinds and is one of the most highly rated conventional insurance companies.

8. Al Dhafra Insurance Company

A publicly owned company that was incorporated in Abu Dhabi under Emily’s Decree No. 8 of 1979 and registered under the provisions of the UAE Insurance Act. The company is one of the leading insurance companies in the United Arab Emirates and offers services.

9. Al Sagr National Insurance Company:

Dubai’s Al Sagr National Insurance Company was founded on 25 December 1979 as a publicly-traded company by Sheikh Rashid Bin Said Al Maktoum, the late ruler of Dubai and Vice President of the UAE it was done and registered with the United Arab Emirates Department of Economics and Commerce (UAE).

10. Watania Insurance

The company is a part of the Abu Dhabi National Insurance Company. The company is a leading takaful company that offers takaful products. It follows the Islamic rules for providing financial services. People who want insurance policies with the Islamic point of view and states get their policies from here. It is the leading auto insurance company in the entire United Arab Emirates.

How does it work?

This is an agreement between two people, namely the insurance company (insurance company) and the insured person (client). Insurance companies develop policies that define the terms of the insurance policy they provide, such as policy limit, premium (price), and deductions. Premium/price is the monthly expenses of the insurance company that customers collect to pay for future losses. The award complies with state standards.

Insurance companies do not receive large premium amounts because they do not want customers to escape.

A policy limit is a predetermined time when the insurance company will pay losses covered by the policy. Limit on the injury, loss, etc. Maybe. It can also be the total lifetime of the system, known as the maximum lifetime. Policies with higher limits have higher premiums as well.

Finally, it is the amount paid by the deductible insurance company before paying for losses. Unemployed exemptions act as a warning against various claims. Depending on the insurer and type of insurance, it can be applied per insurance.

walis khan from DIP2.near al Fida hiper market