Mashreq Bank Credit Card in UAE July 2024 - Total 4

With the vision of becoming the most advanced bank in the Middle East, Mashreq Bank opened in 1967. Originally called Oman Bank, Mashreq Bank easily became the earliest private bank in the UAE. The bank is the nation's premier honor holder, including:

• Mashreq Bank is the first bank established in the UAE

•...e:pre"> Mashreq Bank Credit Card is the first credit card in the UAE

• The chip-based Mashreq credit card is also the first in the UAE.

• Mashreq Bank is also the first bank in the UAE to issue debit cards.

Mashreq Bank conducts international business in 9 countries/regions and trades on the Dubai Financial Market (DFM) under the heading DFM: MASQ. The Mashreq credit card series has more than 50 years of experience and is designed to professionally meet the needs of its growing and already large customer base. As of 2017, Mashreq Bank had more than 2.6 trillion dirhams of bank assets.

Mashreq Bank currently offers 9 types of Mashreq credit cards, and its benefits include daily expenses such as movie theater expenses, cash rebates for utility bills, and international travel discounts. The details of various Mashreq bank credit cards are as follows:

• Mashreq Cashback credit Card

• Mashreq Smile Credit Card

• Mashreq Business Platinum Credit Card.

• Mashreq Smart saver Credit card.

• Mashreq portraits credit card

• Mashreq corporate credit card

• Mashreq Novo credit card

• Mashreq Platinum Elite card

• Mashreq Solitaire Credit card

• Mashreq smart saver global credit card.

1. Mashreq Cashback credit Card

Features:

• You need a monthly salary of at least AED 7,000 to be eligible for this card

• Up to 55 days interest-free period

• The foreign currency exchange rate applicable to overseas transactions is 2.79%

• Free for life

• Joining discount: unlimited double cashback for 3 months-unlimited; cashback for food and beverage consumption 10%; cashback for international expenditure 4%; cashback for domestic expenditure 2%

• 1.39% monthly balance transfer fee

Benefits

• Free for life 20% cash back at Netflix, Careem, Noon, etc.

• Dining cashback 5%

• 2% international cash back, 1% cash back on domestic expenses

• Unlimited cashback 30% discount at 2,000 dining establishments in the UAE

• Instant cash back

• Free purchase protection, all consumption within the first 6 months can get 0% interest, and enjoy long-term warranty

• Free travel insurance

2. Mashreq Smile titanium Credit Card

Benefits

• Enjoy up to 30% discount when dining at any local and international restaurant in more than 2000 Mashreq restaurants

• 0% Simple Payment Plan-Convert your purchase into a convenient payment plan with more than 1,000 outlets and more than 100 partner brands in the UAE

• Free travel insurance

Features

• You need a monthly salary of at least 10,000 dirhams to use this card.

• Up to 55 days interest-free period

• The foreign currency exchange rate applicable to overseas transactions is 2.79%

• The annual fee applicable to this card is AED 300

• When paying the annual fee and spending on the bank card, you can enjoy up to 30,000 “miles”

• For every dirham spent locally and internationally, you can earn 1.5 miles. Redeem more than 300 airline tickets, hotel reservations and vacation packages.

• This card has no cash back

• 1.39% monthly balance transfer fee.

3. Mashreq Solitaire Credit card

Benefits:

• Cash back 2,000 dirhams-at least 3 transactions.

• 100 dirhams for the first two months

• 20% cashback on Zomato, Careem, Netflix, Noon.com, UberEats, iTunes, Uber, Du, Talabat, Amazon Prime, Dubainow and Etisalat

• Unlimited fitness first privilege

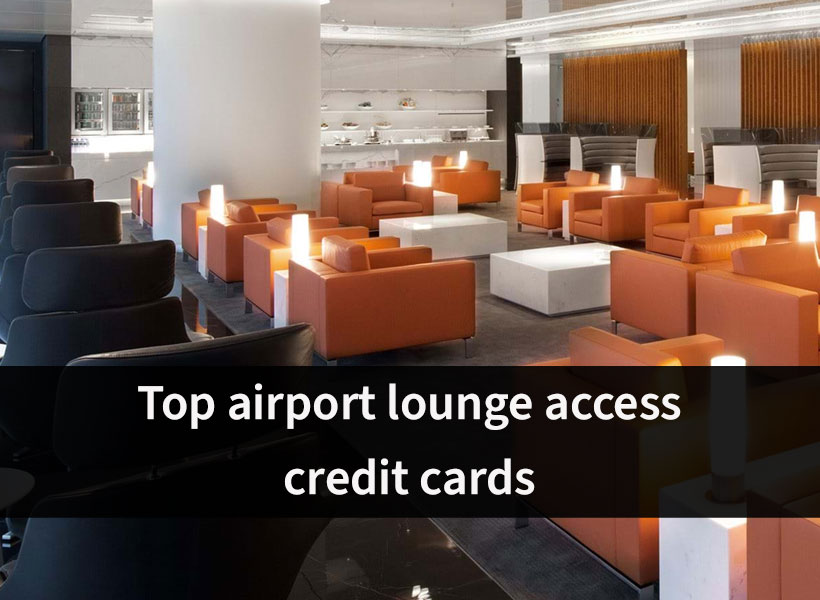

• Enter the airport lounge

• Airport shuttle service

• Premium dining privileges: you will receive exclusive discounts of up to 30% at crèmede lacrème restaurant in the UAE

• Valet parking service

• Car registration and service transfer

• Custom loyalty solution with Salaam points

Features

• You need a monthly salary of at least AED 25,000 per month to be eligible for this card.

• Up to 55 days interest-free period

• At least 3 retail transactions, free annual fee + AED 2,000 cash back in the first year. The value of the first two months is AED 100.

• As a Mashreq Solitaire credit card member, you will earn 1 Mashreq Salaam points for every dirham in domestic retail spending and 3 Mashreq Salaam points for every dirham in international retail spending.

• Salaam points can be redeemed to any destination, online ticket of any airline at any time.

• 1.39% monthly balance transfer fee

• Receive 20% cashback within the first six months of the following merchants: Zomato, Netflix, Talabat, Uber, Uber Eats, Careem, Etisalat, Du, Noon, etc. Each merchant can return up to AED 50 cash per month.

4. Mashreq Smart saver Credit card.

Benefits

• Enjoy up to 30% discount when dining at any local and international restaurant in more than 2000 Mashreq restaurants

• 0% Simple Payment Plan-Convert your purchase into a convenient payment plan with more than 1,000 outlets and more than 100 partner brands in the UAE

• Free travel insurance.

Features

• You need a minimum salary of AED 10,000 per month to use this card

• Up to 55 days interest-free period

• There is no annual fee for this card

• Local purchases can get 0.5% cashback, international purchases can get 1% cashback. In addition, over 450 outlets in the UAE can receive up to 8% cash back

• There are no mileage plans on this card 1.39% monthly balance transfer fee

• Local purchases can get 0.5% cashback, international purchases can get 1% cashback.

• In addition, over 450 outlets in the UAE can receive up to 8% cash back.

Eligibility criteria

Successful Mashreq bank credit card application depends on many factors, some of which are mandatory government regulations, while others are rules established by Mashreq Bank itself. The eligibility criteria are as follows:

Salary: Although not explicitly mentioned on the Mashreq Bank website, almost every Mashreq credit card carries the relevant minimum monthly income requirement. Applicants are required to provide detailed information on their sources of income and spending power. Mashreq credit card staff will also determine eligibility based on the monthly salary.

Credit history: Mashreq credit card staff will conduct a detailed credit record check on the applicant with the utmost confidence. Past loan and repayment records are a good way to determine whether an applicant may be a good customer or a risky customer.

Personal details: Applicants are required to share certain personal details, such as valid ID and proof of address. Mashreq bank credit card personnel may further share this information during the credit history check.

Security deposit: Mashreq Bank credit card staff may request the applicant to provide a deposit at their own discretion. The amount is determined by the bank and transferred to the customer. After receiving the deposit, the applicant will receive their Mashreq credit card.

Age: The minimum legal age to apply for a Mashreq credit card is 18 years old. Mashreq Bank can also allow minors under the age of 18 to apply together with legal guardians. Customers under the age of 18 should contact the Mashreq credit card representative regarding their application process.

• Mashreq Bank is the first bank established in the UAE

•...e:pre"> Mashreq Bank Credit Card is the first credit card in the UAE

• The chip-based Mashreq credit card is also the first in the UAE.

• Mashreq Bank is also the first bank in the UAE to issue debit cards.

Mashreq Bank conducts international business in 9 countries/regions and trades on the Dubai Financial Market (DFM) under the heading DFM: MASQ. The Mashreq credit card series has more than 50 years of experience and is designed to professionally meet the needs of its growing and already large customer base. As of 2017, Mashreq Bank had more than 2.6 trillion dirhams of bank assets.

Mashreq Bank currently offers 9 types of Mashreq credit cards, and its benefits include daily expenses such as movie theater expenses, cash rebates for utility bills, and international travel discounts. The details of various Mashreq bank credit cards are as follows:

• Mashreq Cashback credit Card

• Mashreq Smile Credit Card

• Mashreq Business Platinum Credit Card.

• Mashreq Smart saver Credit card.

• Mashreq portraits credit card

• Mashreq corporate credit card

• Mashreq Novo credit card

• Mashreq Platinum Elite card

• Mashreq Solitaire Credit card

• Mashreq smart saver global credit card.

1. Mashreq Cashback credit Card

Features:

• You need a monthly salary of at least AED 7,000 to be eligible for this card

• Up to 55 days interest-free period

• The foreign currency exchange rate applicable to overseas transactions is 2.79%

• Free for life

• Joining discount: unlimited double cashback for 3 months-unlimited; cashback for food and beverage consumption 10%; cashback for international expenditure 4%; cashback for domestic expenditure 2%

• 1.39% monthly balance transfer fee

Benefits

• Free for life 20% cash back at Netflix, Careem, Noon, etc.

• Dining cashback 5%

• 2% international cash back, 1% cash back on domestic expenses

• Unlimited cashback 30% discount at 2,000 dining establishments in the UAE

• Instant cash back

• Free purchase protection, all consumption within the first 6 months can get 0% interest, and enjoy long-term warranty

• Free travel insurance

2. Mashreq Smile titanium Credit Card

Benefits

• Enjoy up to 30% discount when dining at any local and international restaurant in more than 2000 Mashreq restaurants

• 0% Simple Payment Plan-Convert your purchase into a convenient payment plan with more than 1,000 outlets and more than 100 partner brands in the UAE

• Free travel insurance

Features

• You need a monthly salary of at least 10,000 dirhams to use this card.

• Up to 55 days interest-free period

• The foreign currency exchange rate applicable to overseas transactions is 2.79%

• The annual fee applicable to this card is AED 300

• When paying the annual fee and spending on the bank card, you can enjoy up to 30,000 “miles”

• For every dirham spent locally and internationally, you can earn 1.5 miles. Redeem more than 300 airline tickets, hotel reservations and vacation packages.

• This card has no cash back

• 1.39% monthly balance transfer fee.

3. Mashreq Solitaire Credit card

Benefits:

• Cash back 2,000 dirhams-at least 3 transactions.

• 100 dirhams for the first two months

• 20% cashback on Zomato, Careem, Netflix, Noon.com, UberEats, iTunes, Uber, Du, Talabat, Amazon Prime, Dubainow and Etisalat

• Unlimited fitness first privilege

• Enter the airport lounge

• Airport shuttle service

• Premium dining privileges: you will receive exclusive discounts of up to 30% at crèmede lacrème restaurant in the UAE

• Valet parking service

• Car registration and service transfer

• Custom loyalty solution with Salaam points

Features

• You need a monthly salary of at least AED 25,000 per month to be eligible for this card.

• Up to 55 days interest-free period

• At least 3 retail transactions, free annual fee + AED 2,000 cash back in the first year. The value of the first two months is AED 100.

• As a Mashreq Solitaire credit card member, you will earn 1 Mashreq Salaam points for every dirham in domestic retail spending and 3 Mashreq Salaam points for every dirham in international retail spending.

• Salaam points can be redeemed to any destination, online ticket of any airline at any time.

• 1.39% monthly balance transfer fee

• Receive 20% cashback within the first six months of the following merchants: Zomato, Netflix, Talabat, Uber, Uber Eats, Careem, Etisalat, Du, Noon, etc. Each merchant can return up to AED 50 cash per month.

4. Mashreq Smart saver Credit card.

Benefits

• Enjoy up to 30% discount when dining at any local and international restaurant in more than 2000 Mashreq restaurants

• 0% Simple Payment Plan-Convert your purchase into a convenient payment plan with more than 1,000 outlets and more than 100 partner brands in the UAE

• Free travel insurance.

Features

• You need a minimum salary of AED 10,000 per month to use this card

• Up to 55 days interest-free period

• There is no annual fee for this card

• Local purchases can get 0.5% cashback, international purchases can get 1% cashback. In addition, over 450 outlets in the UAE can receive up to 8% cash back

• There are no mileage plans on this card 1.39% monthly balance transfer fee

• Local purchases can get 0.5% cashback, international purchases can get 1% cashback.

• In addition, over 450 outlets in the UAE can receive up to 8% cash back.

Eligibility criteria

Successful Mashreq bank credit card application depends on many factors, some of which are mandatory government regulations, while others are rules established by Mashreq Bank itself. The eligibility criteria are as follows:

Salary: Although not explicitly mentioned on the Mashreq Bank website, almost every Mashreq credit card carries the relevant minimum monthly income requirement. Applicants are required to provide detailed information on their sources of income and spending power. Mashreq credit card staff will also determine eligibility based on the monthly salary.

Credit history: Mashreq credit card staff will conduct a detailed credit record check on the applicant with the utmost confidence. Past loan and repayment records are a good way to determine whether an applicant may be a good customer or a risky customer.

Personal details: Applicants are required to share certain personal details, such as valid ID and proof of address. Mashreq bank credit card personnel may further share this information during the credit history check.

Security deposit: Mashreq Bank credit card staff may request the applicant to provide a deposit at their own discretion. The amount is determined by the bank and transferred to the customer. After receiving the deposit, the applicant will receive their Mashreq credit card.

Age: The minimum legal age to apply for a Mashreq credit card is 18 years old. Mashreq Bank can also allow minors under the age of 18 to apply together with legal guardians. Customers under the age of 18 should contact the Mashreq credit card representative regarding their application process.

Read More

Best Mashreq Bank Credit Card in UAE

| Credit Card | Minimum Salary | Rate |

|---|---|---|

| Mashreq - Platinum Elite Credit Card | 10,000 | 3.45% |

| Mashreq - Solitaire Credit Card | 25,000 | 3.45% |

| Mashreq Bank - sMiles Credit Card | 5,000 | 3.45% |

| Mashreq Bank - Cashback Card | 10,000 | 3.45% |